Authorship Doesn’t Wait for Liquidity

At 8:04 PM ET, I sent out a note: Go long.

No over-analysis.

No qualifiers.

Just the call.

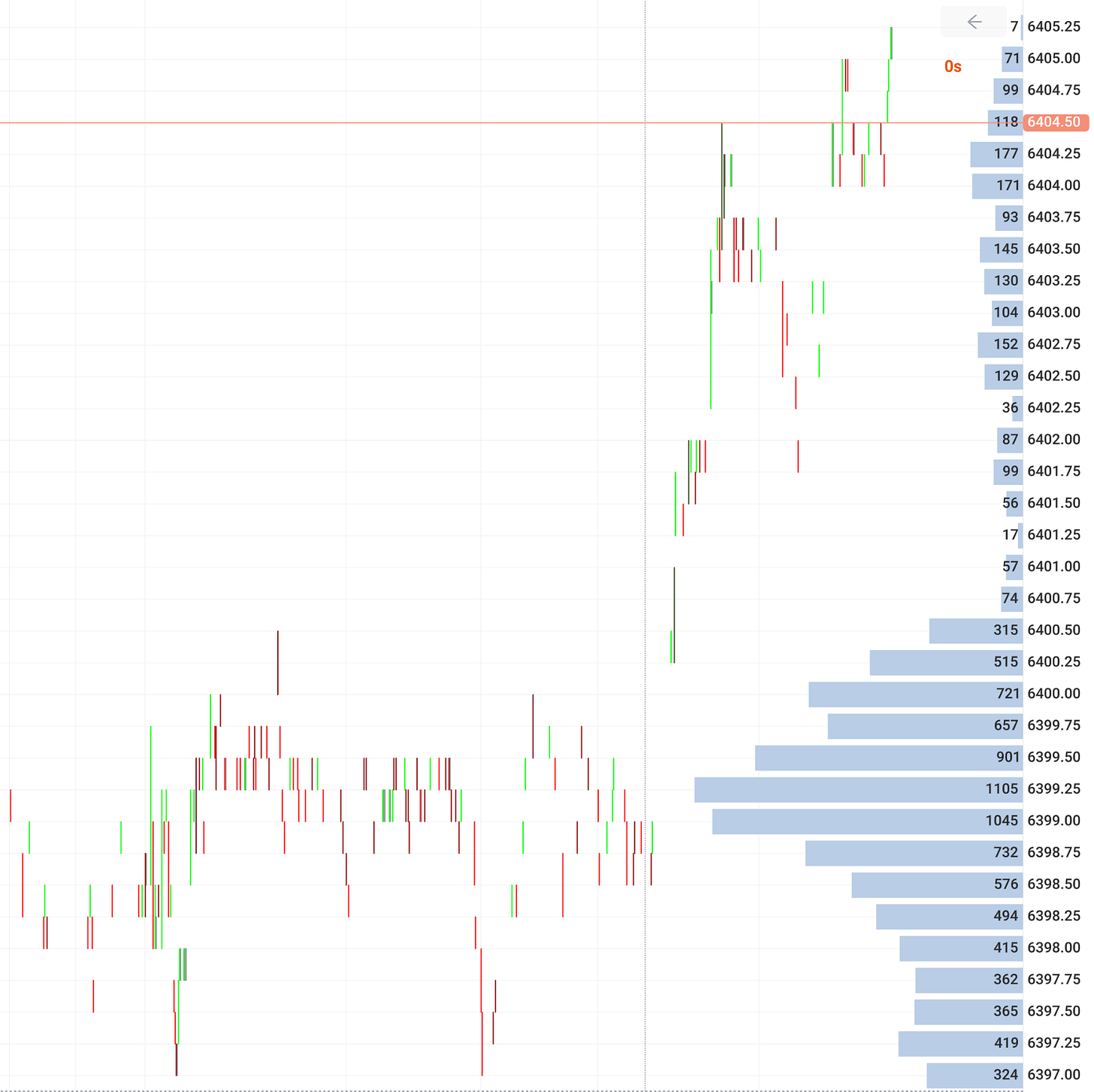

By now you could see it — a sharp, clean burst in the S&P.

Not “big” in terms of points, but unmistakable in terms of speed and precision. The market didn’t drift there. It moved.

What matters here isn’t the tariff headline that dropped.

It’s that the authorship effe…