CVOL: The Rug Pull That Bent Probability

Bending Probability, Bending Time

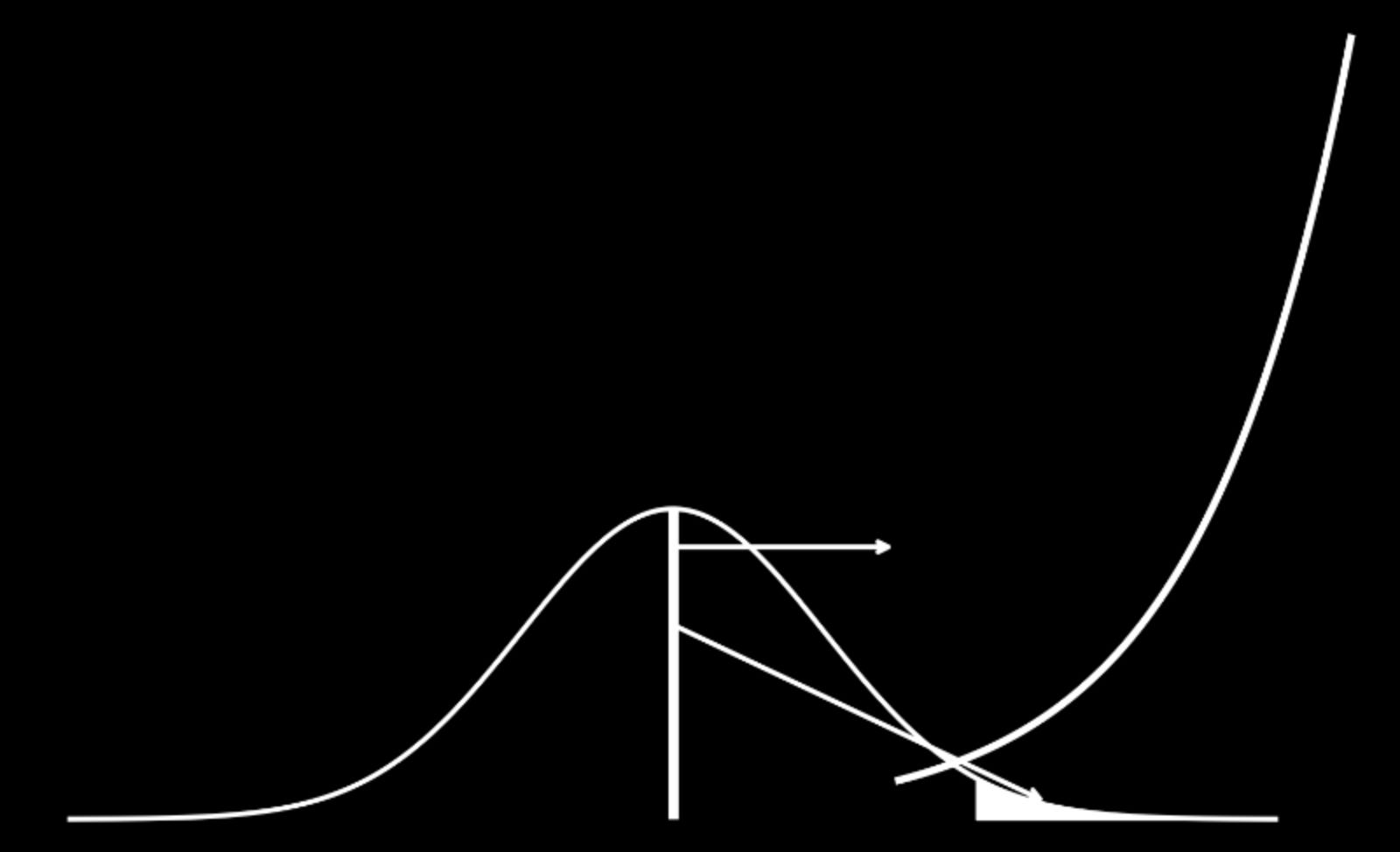

Probability bent:

Everyone else assumes market outcomes are bound by distributions — fat tails, Gaussian drift, event risk. But when I authored the 6500 hinge and the post NFP support, I didn’t sample from a distribution, I moved the distribution itself. Suddenly what “should” have been a tail event — the spring broad for…