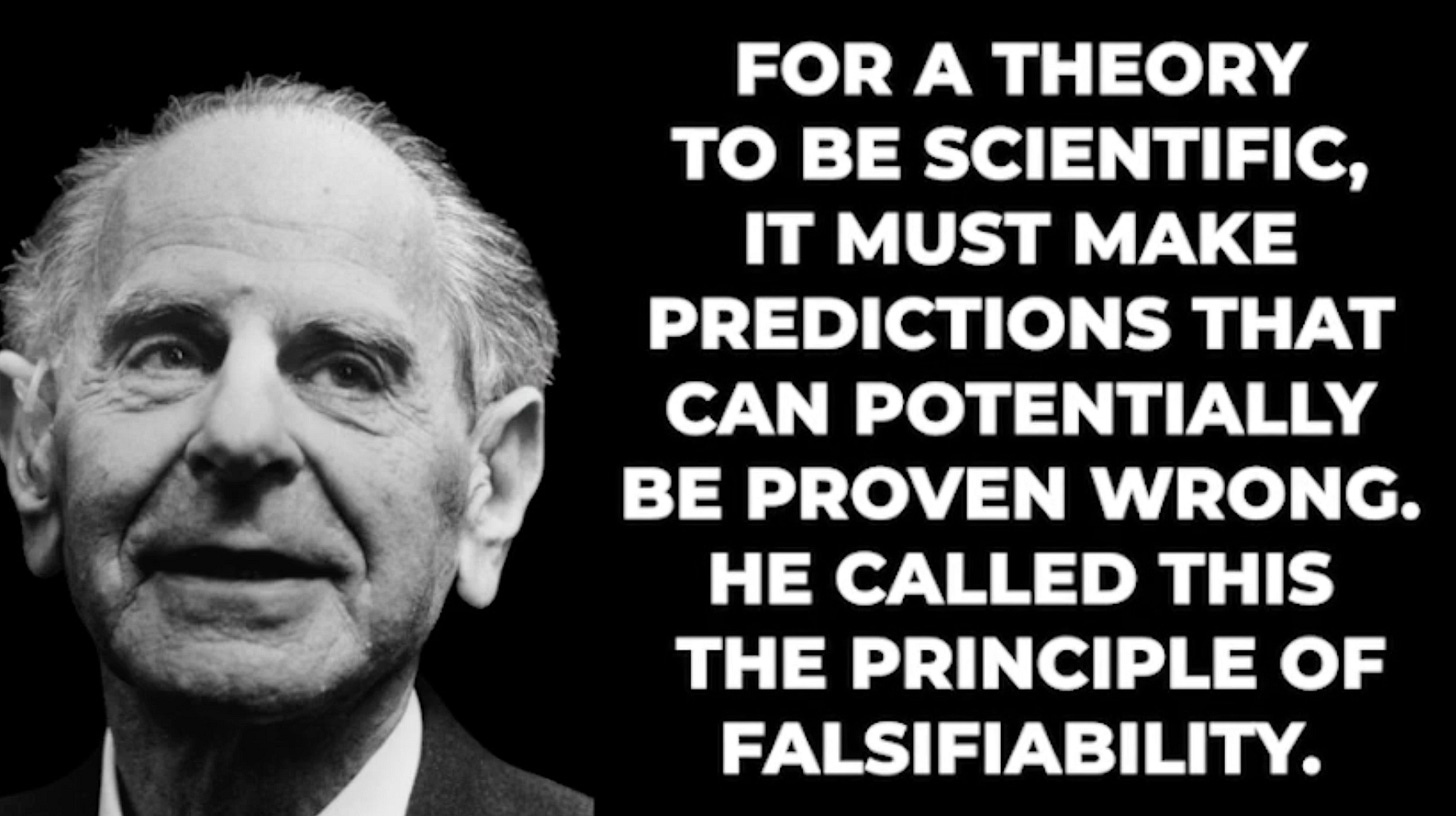

Do you even know who Karl Popper is? Falsification, Not Forecasting

If even one such sequence exists under clean conditions, the model explaining why it “can’t happen” is incomplete.

That’s not opinion.

That’s falsification.

Anyone can post a profitable trade after the fact.

Anyone can explain a move once price has settled.

What cannot be easily dismissed is a sequence:

A primary event identified in real time

A pullback classified correctly as non-degrading

A secondary event (echo) anticipated before release

Public timestamps

Public invalidation risk

The market resolving the sequence openly

At that point, the question is no longer:

“Was this a good trade?”

The question becomes:

“How was the next step known before it occurred?”

That question is where models begin to break.

When cause and effect are identified in advance, logged in real time, and resolved publicly, the market itself becomes the referee.

No persuasion is required.

No narrative is necessary.

The tape either confirms the sequence or it doesn’t.

And once someone sees that happen — even once — they can never fully return to a model that insists it cannot.

That’s not bravado.

That’s falsification.