Execution-Based Finance Breaks Into Academic Circulation

Most papers on SSRN come from professors, PhDs, or research desks. They carry the badges of NYU Stern, Stanford GSB, or BlackRock.

Mine didn’t.

No academic chair.

No institutional affiliation.

And yet —

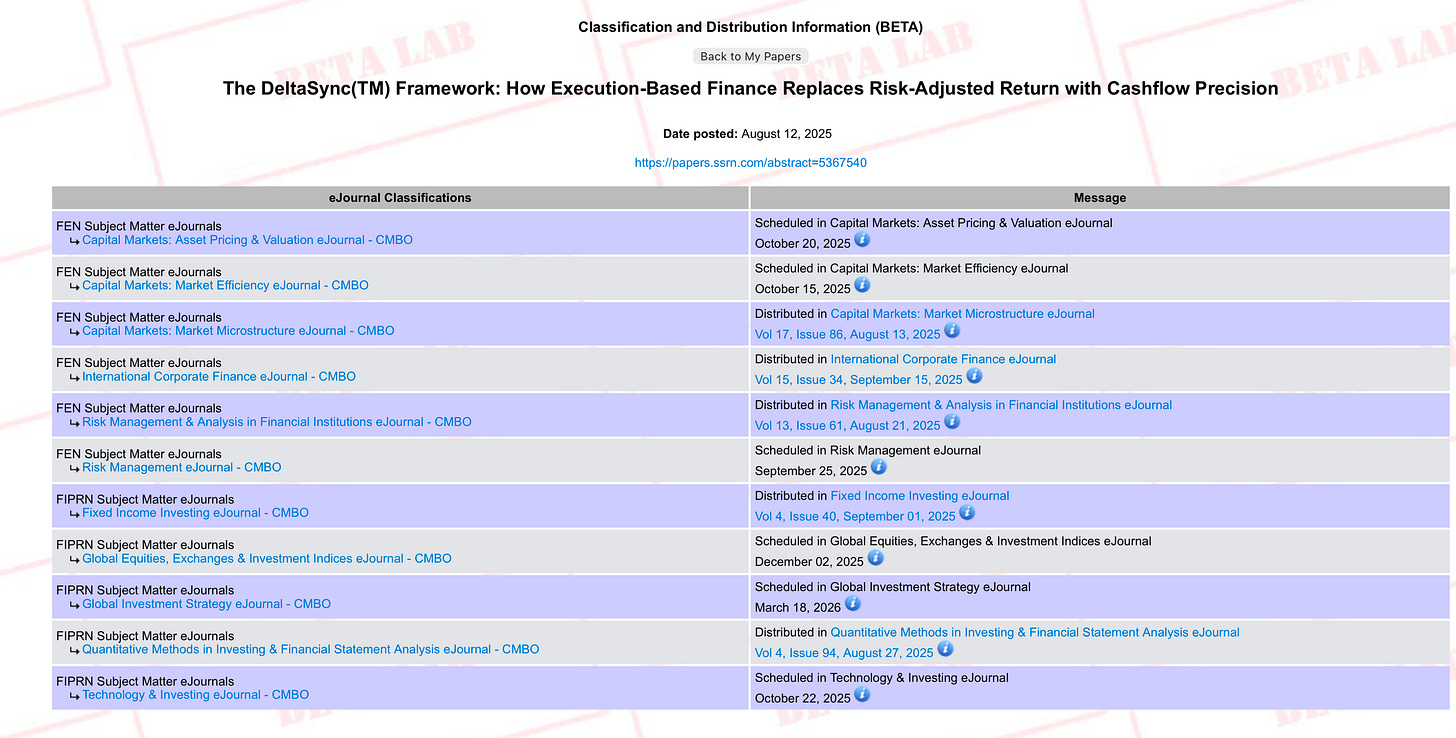

My paper, The DeltaSync™ Framework: How Execution-Based Finance Replaces Risk-Adjusted Return with Cashflow Precision, has already:

Been classified into 10 di…