How they 'beat' the market v Authorship

Below is what most equity curves actually look like—and why authorship produces a different shape entirely. Authorship isn’t about predicting the destination.

It’s about controlling the route.

And the route is the only part you can consistently monetize.

What you’re seeing

Each chart below is a behavioral model disguised as P&L.

It’s not “market randomness.”

It’s the trader’s decision-making under pressure—size, exits, discipline, and survival.

The Typical Trader vs. Authorship

Strength (Typical)

Easy to start: follow patterns, follow narratives, follow indicators.

Lots of “small wins” when conditions are calm.

Weakness (Typical)

One bad day erases weeks of work.

Profits depend on being right about “why,” not being precise about “how.”

Opportunity (Authorship)

Monetize decision points (the gate), not opinions.

Can extract small, repeatable edges because the market is forced to choose.

Threat (Authorship)

Variance

Not being aligned with the tape.

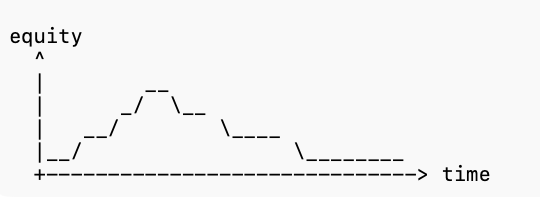

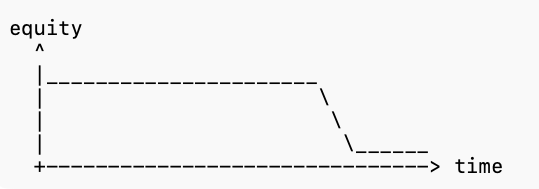

The classic “staircase + cliff” (most common)

They grind up… then one day erases everything.

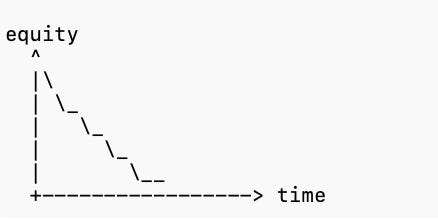

The “sawtooth bleed” (death by 1,000 cuts)

They’re active, but their edge is negative or costs/slippage dominate.

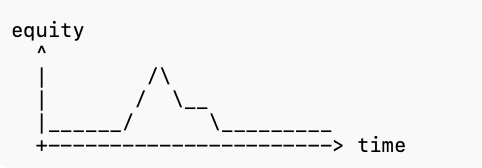

The “hero curve” (one lucky run, then giveback)

They spike from a big day… then revert to the mean (or blow up).

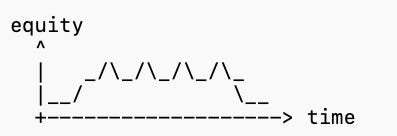

The “range-bound chop” (flat for months)

Looks disciplined, but it’s actually fear + randomness.

The “martingale illusion” (smooth… until it isn’t)

This one looks amazing right up until it detonates.

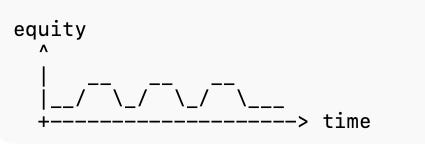

Authorship

A tighter “controlled band” approach—small amplitude, fewer tail events:

The moves above it are not random wiggles — they’re bursts of extractable structure.

That’s why it looks like a pulse. Pulse = market compresses → releases → harvest → go flat again.

My equity curve is a seismograph. Each pulse is a captured variance collapse, and the flat floor is the refusal to fund noise relative to the 90% win rate and controlled MAE.

Conclusion:

Their curve is a story about exposure.

Mine is a story about control.

They accumulate risk until the market collects it.

I extract edges where the market can’t avoid deciding.