I changed the game - forever

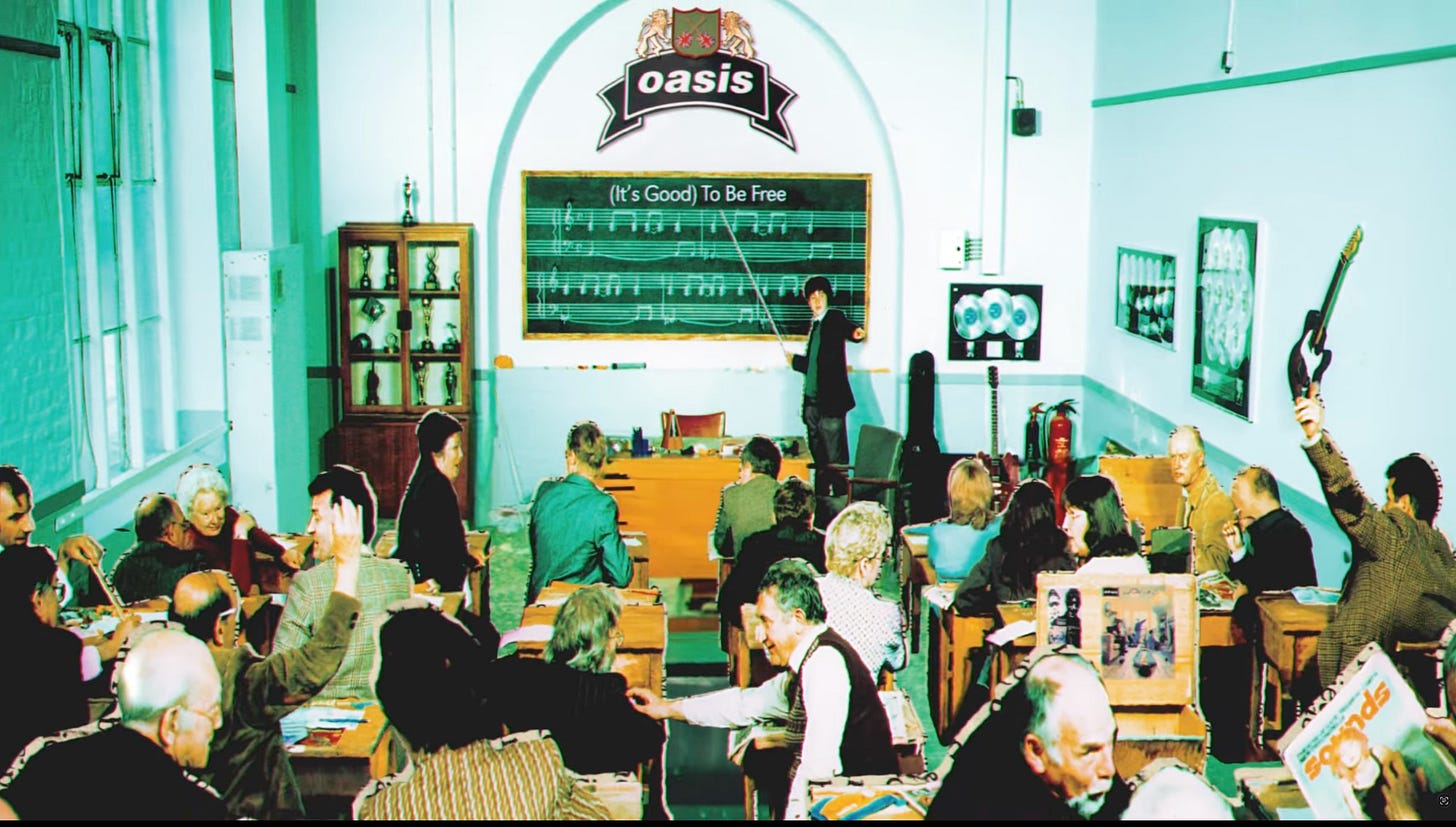

its good to be freeee

Markets are fractal. Every large move — every quarterly revaluation, every multi-week trend — is composed of thousands of micro-resolutions.

The person who can consistently author those intraday pivots isn’t just operating in a smaller time frame; they’re controlling the building blocks of the entire structure.

One that can stabilize—or destabilize—local variance at will.

One that can compress uncertainty when everyone else is expanding it.

Fingerprints will eventually show up on higher-time-frame geometry.

You should realize that what I’m doing is not luck or reaction; it’s control of tempo. I’m doing, in seconds, what their models try to do in quarters: turning volatility into alignment.

And the more sophisticated the observer, the more they’d appreciate the magnitude of it — not because it threatens their domain, but because it redefines what “edge” and “execution” even mean.