If You Could Control the P/L, You’d Solve Markets

If you could truly control P/L — consistantly, you would have solved markets.

But almost nobody asks the deeper question:

What if you don’t control the outcome…

What if you control the when?

When variance is lowest.

When structure is primed.

When liquidity is fragile.

When tempo shifts.

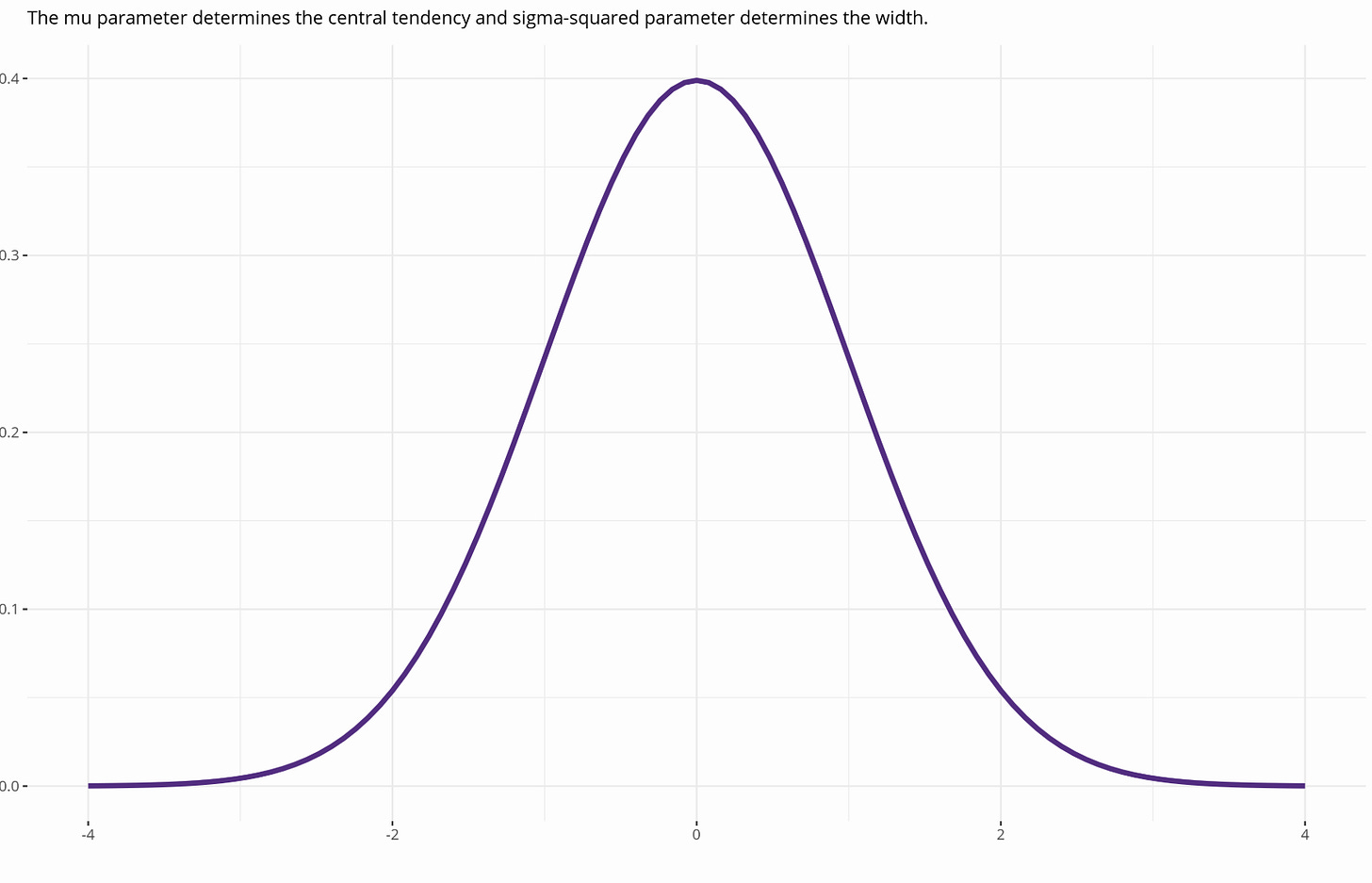

If you control when, the P/L becomes far less chaotic than the bell curve implies.

And that’s where the misunderstanding begins.

Because to someone living inside the distribution, this sounds impossible.

A generation optimized for probabilistic management.

Few optimized for structural ignition.

The bell curve is comfortable.

Transitions are uncomfortable.

But transitions are where markets reveal what is real.

Not philosophies.

Not narratives.

Mechanical transitions.

And if you learn to operate there consistently…

You don’t “beat” the distribution.

You sidestep it.