If/Then Sees Probability. 5H1W Sees Participation

If/Then is how the crowd sees

Most market participants—regardless of their label—operate inside the same mental operating system:

technicians: “if we break X, then we go Y”

regime people: “if vol expands, then trend changes”

flow chasers: “if dealers flips, then we squeeze”

order-book watchers: “if bids stack, then we lift”

Different costumes. Same core: if/then probability.

And probability thinking is powerful because it creates collective behavior.

Everyone is waiting for the same trigger, even if they explain it differently.

That’s the key.

5H1W is not prediction — it’s control of the trigger

What I do with 5H1W (Who/What/When/Where/Why/How) is different.

5H1W isn’t a “signal.”

5H1W creates a window and then operates inside it.

And because I understand how the if/then crowd interprets the tape, I can see something most people miss:

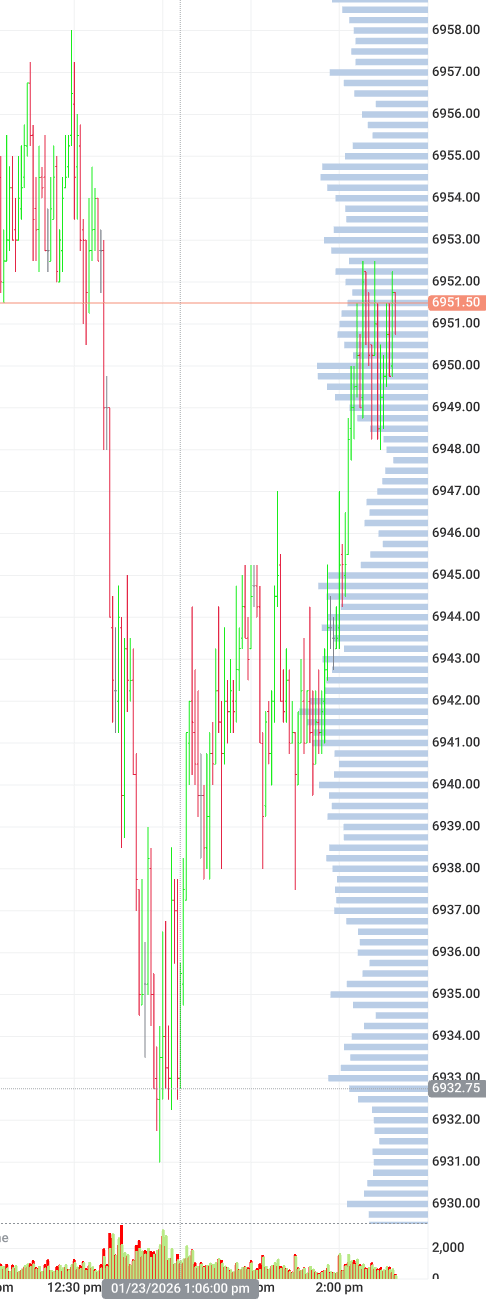

Tiny moves build the geometry that makes everyone else “right”

Sometimes a single tick matters—not because the tick is “magic,” but because it completes the shape.

That shape can be:

a breakout level

a clean reclaim

a wick that flips sentiment

a micro-range that compresses into a one-way move

To the crowd, that’s “confirmation.”

To me, it’s the moment participation becomes socially permitted.

The market isn’t just discovering price.

It’s discovering agreement.

One tick can change the entire regime because it changes what the crowd believes is now “allowed.”

That’s the beauty of it.

It’s not mysticism.

It’s coordination.

Sharp distinction between probability-based thinking and coordination-based thinking. The insight that 'one tick can change the entire regime because it changes what the crowd believes is now allowed' nails the social dynamics of market structure. Most traders obsess over probability signals but miss how markets are fundamentaly coordination games. Reminds me of Keynes' beauty contest, where winning is about predicting what everyone else will think not what's 'objectively' true.