No Market, No Sovereignty: GDP as State Property

But market cap isn’t just “wealth.” It’s a claim on future cashflows—and more importantly, it’s a map of who controls those claims.

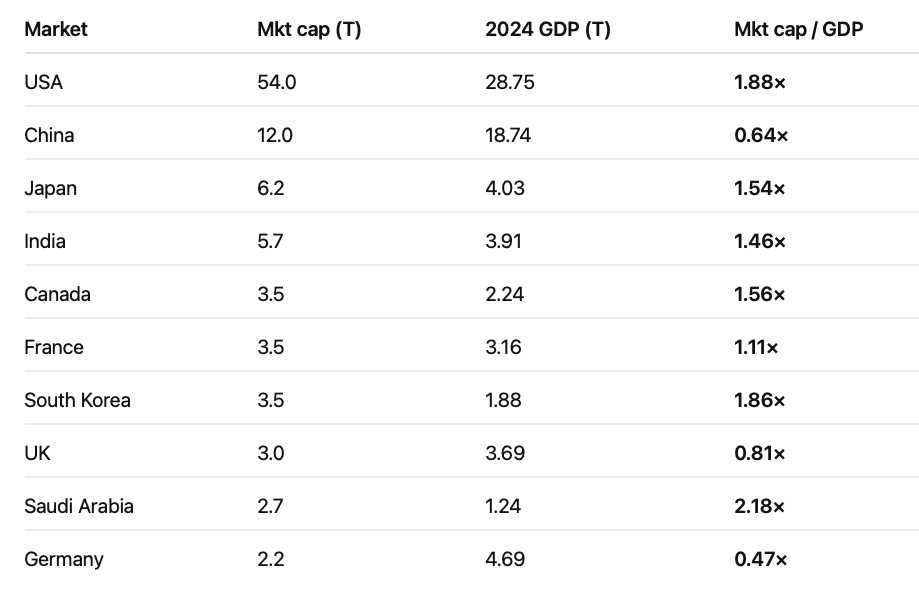

So I ran a simple normalization: stock market cap ÷ GDP.

If market value is not widely held by households + private institutions, it is held by some concentrated owner—often the state, otherwise controlling private blocs (families/founders) or foreign capital.

Estimates:

State-connected market cap (China): ~35%–60%

State-connected market cap (Saudi): ~70%–90%

State-connected market cap (US): likely low single digits (≈0%–5%)

If a market’s capitalization is not meaningfully dispersed among households and private institutions, it does not magically become “people’s wealth.”

It becomes someone’s balance sheet—often the state’s, otherwise a tight control bloc (families, founders, corporate groups), sometimes foreign capital.

China is the most interesting case.

Its market is large, but a substantial share of that value is state-connected—SOEs, state stakes, and state-adjacent control. In other words: a meaningful chunk of “China’s stock market” is not the private sector compounding in public—it’s the state pricing its industrial architecture in real time.

Saudi Arabia makes the idea impossible to ignore.

If the crown and the sovereign wealth fund effectively own most of the flagship company that dominates the index, then the market cap is not “dispersed capitalism.”

It’s a state engine with a ticker symbol.

The U.S., by contrast, is unusual because ownership is much more widely distributed through retirement systems and household balance sheets.

It makes it structurally different: the equity market is closer to a private-sector transmission mechanism than a state balance sheet.

This is one of many proofs that individual sovereignty is structurally stronger in the U.S. than in most of the world.

Despite what may others say without studying the structure.

This is such a smart frame for thinking about sovereignty! The mkt cap/GDP ratio as a map of control is brillant - really shows why the US feels structurally different from other major economies. The Saudi Arabia example is wild, basically a state engine with a ticker lol. Makes you realize how much economic freedom we actualy have here compared to most of the world.