Owning the Master Clock: Why Global Market Tempo Can’t Be Duplicated

In global finance, there’s only one master clock: the S&P 500’s tempo.

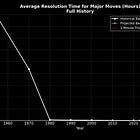

It dictates when value is recognized, how fast risk shifts are priced, and how trillions of dollars in capital move. Once you control that clock, you don’t just participate in the market — you set the beat for it.