Systematic Cash Flow from Futures

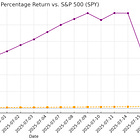

Over an 8-day trading window, I executed a series of risk-managed trades using ES futures.

This week we generated a risk adjusted return of approximately +68.75%.

Structured, Repeatable, and Controlled.

With an almost 80% consistency ratio of the highest P/L day.

This is a major signal of process-driven edge, not randomness.

Even with two down days, the co…