The Blind Spot of 'Long-Term' Thinkers

There’s a fundamental flaw with long-term thinkers: they ignore that, just like everything else in life, the market compresses into a handful of critical highlights — pivotal moments. If certain permutations don’t occur, an entirely different reality unfolds. This isn’t theoretical; it happens in the market every single day.

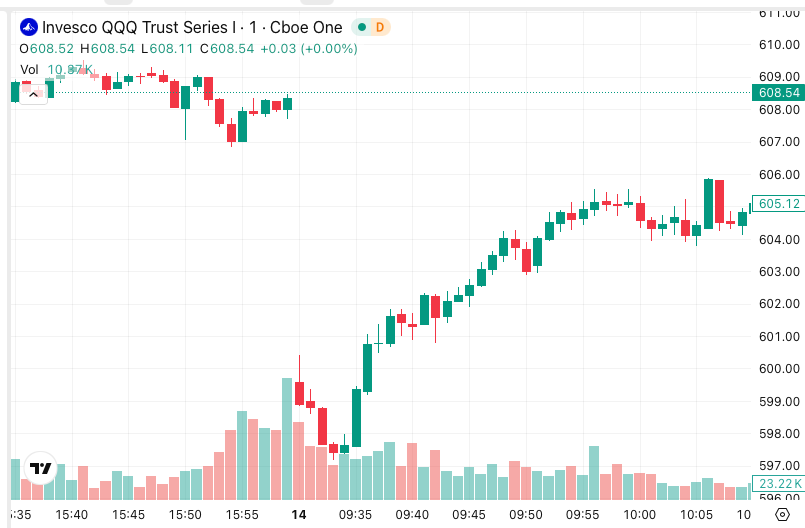

Excuse me, sir — you’re conveniently ignoring the fact that after the open, the market could have easily dropped another full percent. That hinge level was critical because nothing else was going to stop the slide. Panic was at its peak. Now everyone is acting like a Monday-morning quarterback, pretending it was all obvious and everything was “fine and dandy.”