The Jordan Principle of Markets: Precision Over Variance

The GOAT debate is always settled so elegantly: he was the most precise in temporal control. For example, Jordan is 6-for-6 — six Finals appearances, six rings, six Finals MVPs.

In contrast, LeBron’s record shows more flawed Finals appearances and a clear case of temporal drift — and the fact that there are so many ifs and thens around his Finals record is almost a reflection of survivorship bias.

This pattern applies across all professional sports.

If we extend this idea to finance, the same principle holds: true greatness requires precision in temporal control.

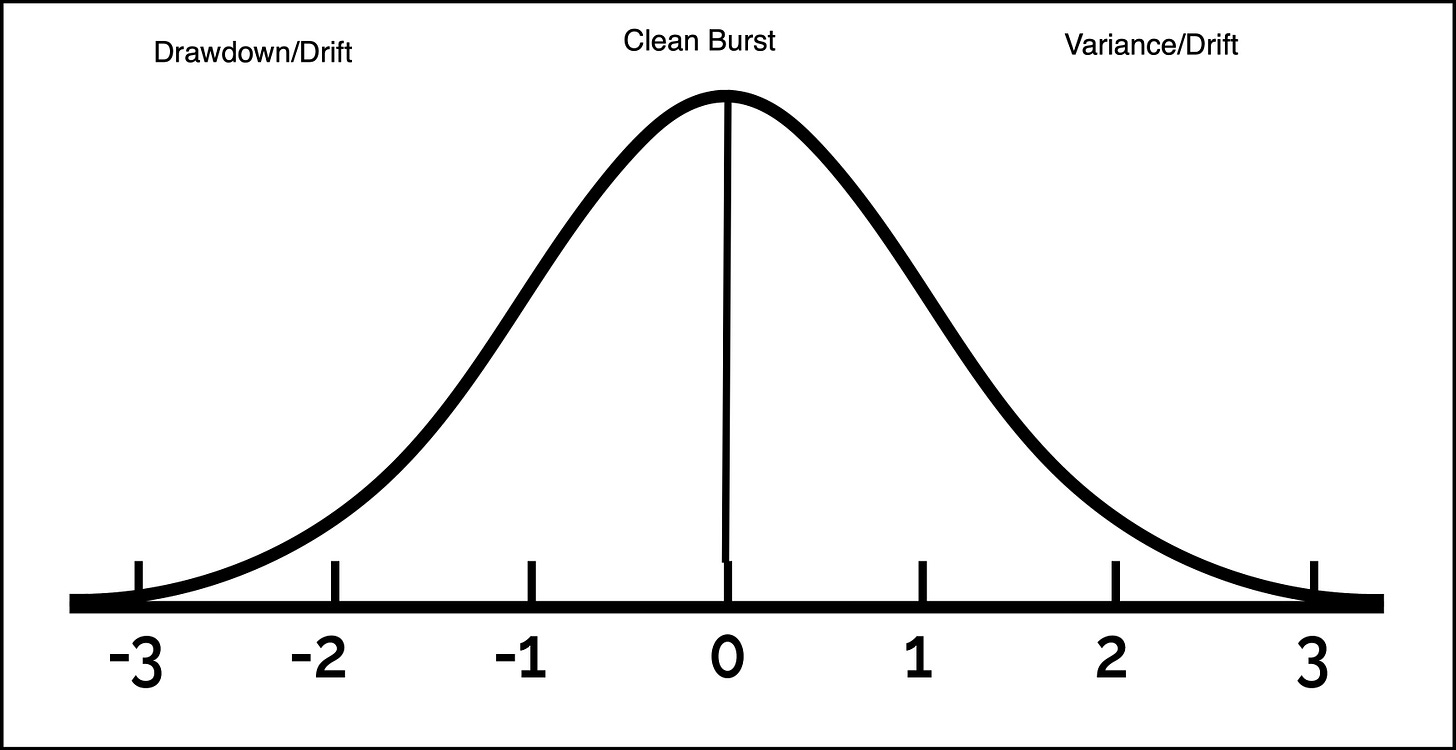

You can’t live in variance and drift; you must operate with timing so exact that outcomes converge toward inevitability.

It’s really that simple.