The Niche Inside the Macro That Actually Produces Outcomes

Once you view the economy through a price-to-weight lens, inflation becomes almost mandatory.

What’s happening is simple: value is being forced back into things with irreducible physical or operational density. When assets have weight—whether literal or infrastructural—the price has no choice but to be accepted. There’s no synthetic substitute.

….The GPU-as-hard-asset argument cuts through the usual tech narratives - you're right that there's an irreducible floor under compute capacity that software subscriptions don't have. I've watched private mkts reprice away from pure abstraction this past year, especially where infra costs started mattering again. This lens makes recent capital flows way less confusing.

You see this not just in GPUs, memory, and RAM becoming institutionalized through data centers, but even in cultural assets. Vinyl is a great example: it’s not about nostalgia, it’s about compression of experience into form. Scarcity, durability, ownership. Same logic as metals, same logic as compute.

Anything that is 100% invisible—pure cloud utilities, SaaS with no anchoring to databases, infrastructure, or ownership—faces the most pressure. Near-zero marginal cost plus abstraction is exactly where repricing has to happen.

That’s also why the dollar behaves differently than crypto. There’s still paper currency circulating, still physical settlement at the base layer, even if higher abstractions sit on top. It’s a hybrid asset, not a pure claim. Same with precious metals, sports cards, collectibles: they all retain a physical or custodial floor.

And this ties into where the future is going.

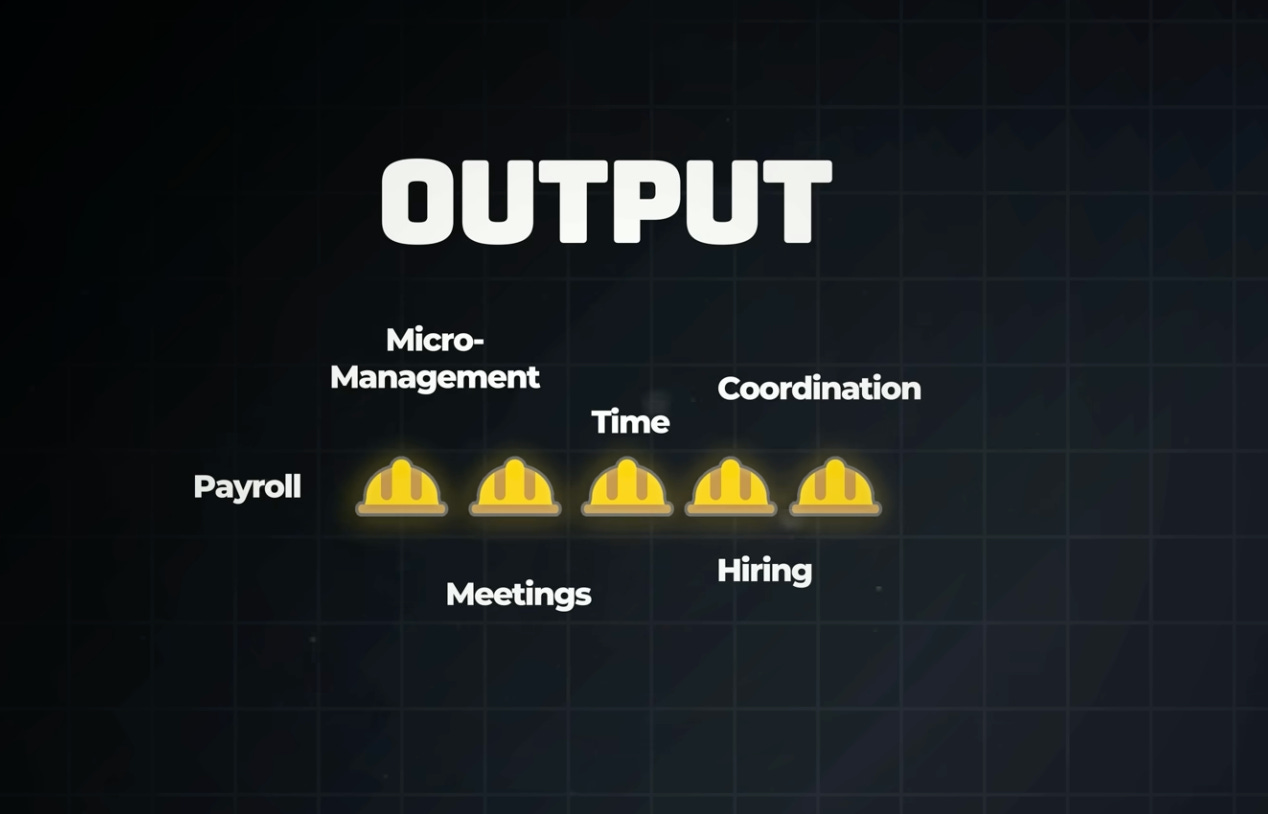

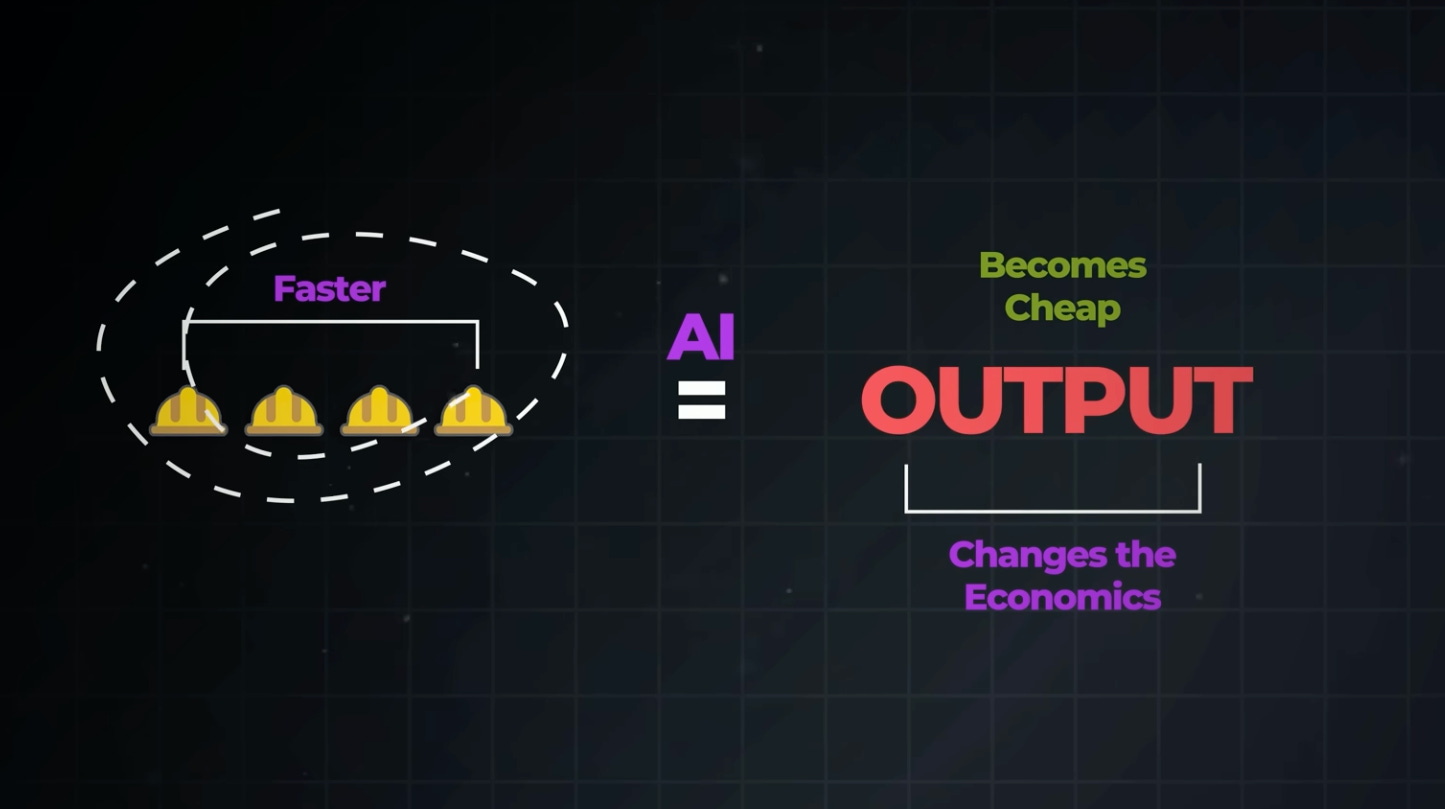

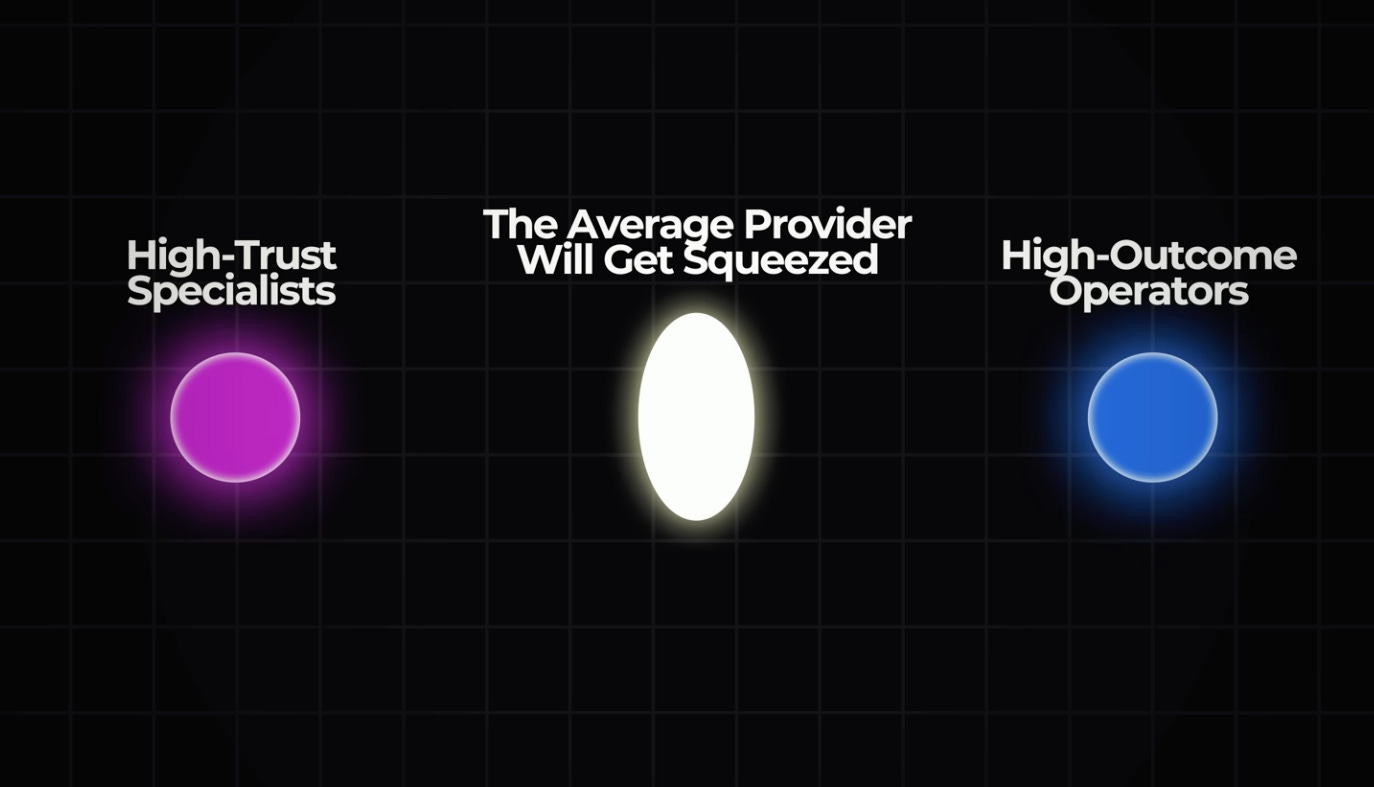

If you buy into the SaaS-pocalypse hypothesis, every individual is being pushed into a world where they must compete with their own best stack of technology and AI agents. Output becomes commoditized. What differentiates is direction, not production.

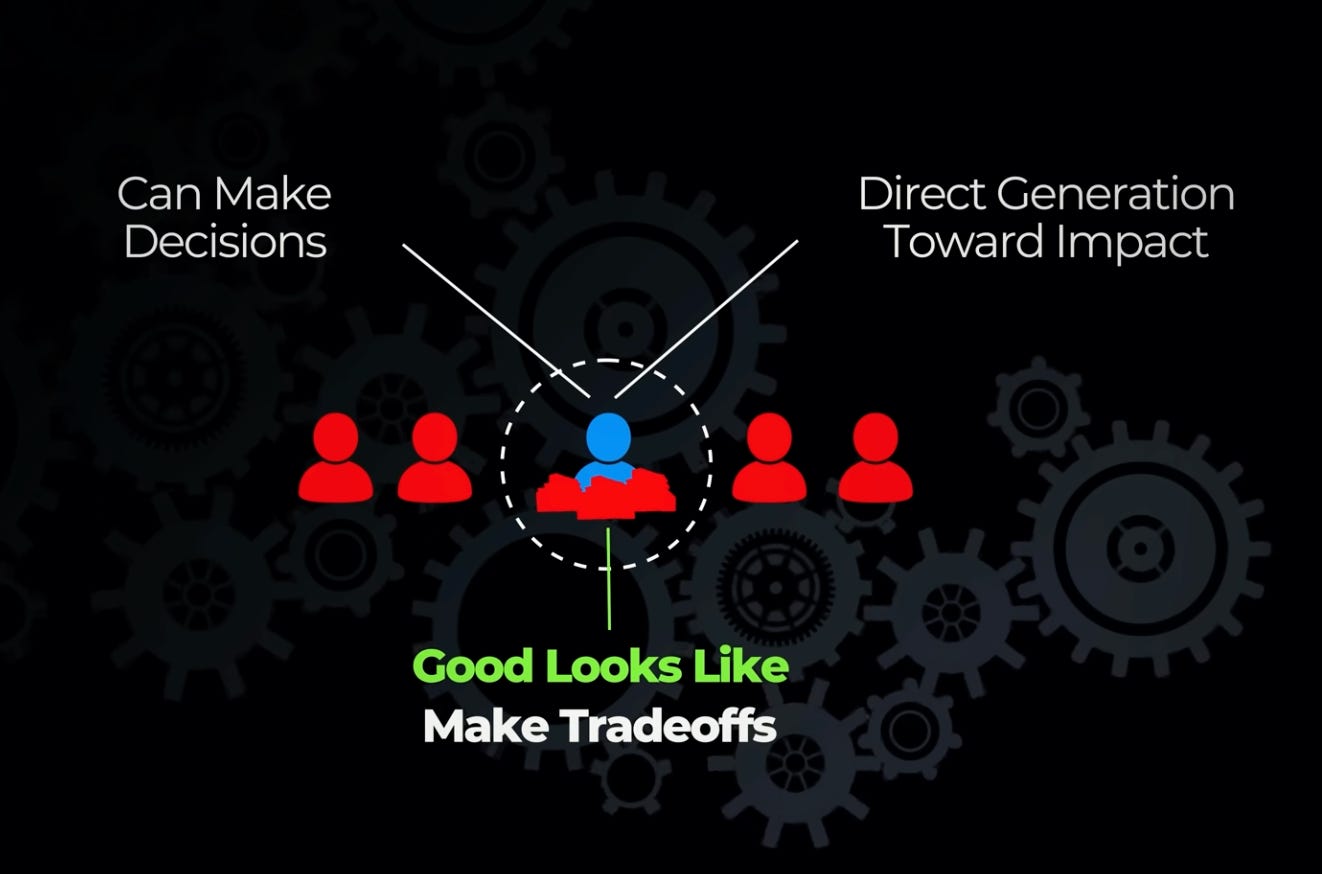

The real value is in being the maestro — the director of systems, tools, and agents — not the laborer. That orchestration layer is scarce, and it can be monetized precisely because it sits on top of real infrastructure.

So inflation isn’t a bug here.

It’s the system re-pricing weight, constraint, and density back into the economy.

Once you see that, the capital flows stop looking confusing at all.