When a $25B Value Fund Underperforms and Searches for an Edge

I assumed the challenge was to reconcile technical and fundamental analysis within a unified probabilistic framework, which naturally led me toward quantitative and statistical models.

What I eventually discovered is that probability is not the foundation — it is a symptom.

When a fund begins to suffer drawdowns, variance, and redemptions, the response is almost always the same: search for an edge.

The question doesn’t change—only the vocabulary does.

How do you mitigate drawdown?

How do you compress variance?

How do you avoid being forced to explain losses while waiting for a thesis to mature?

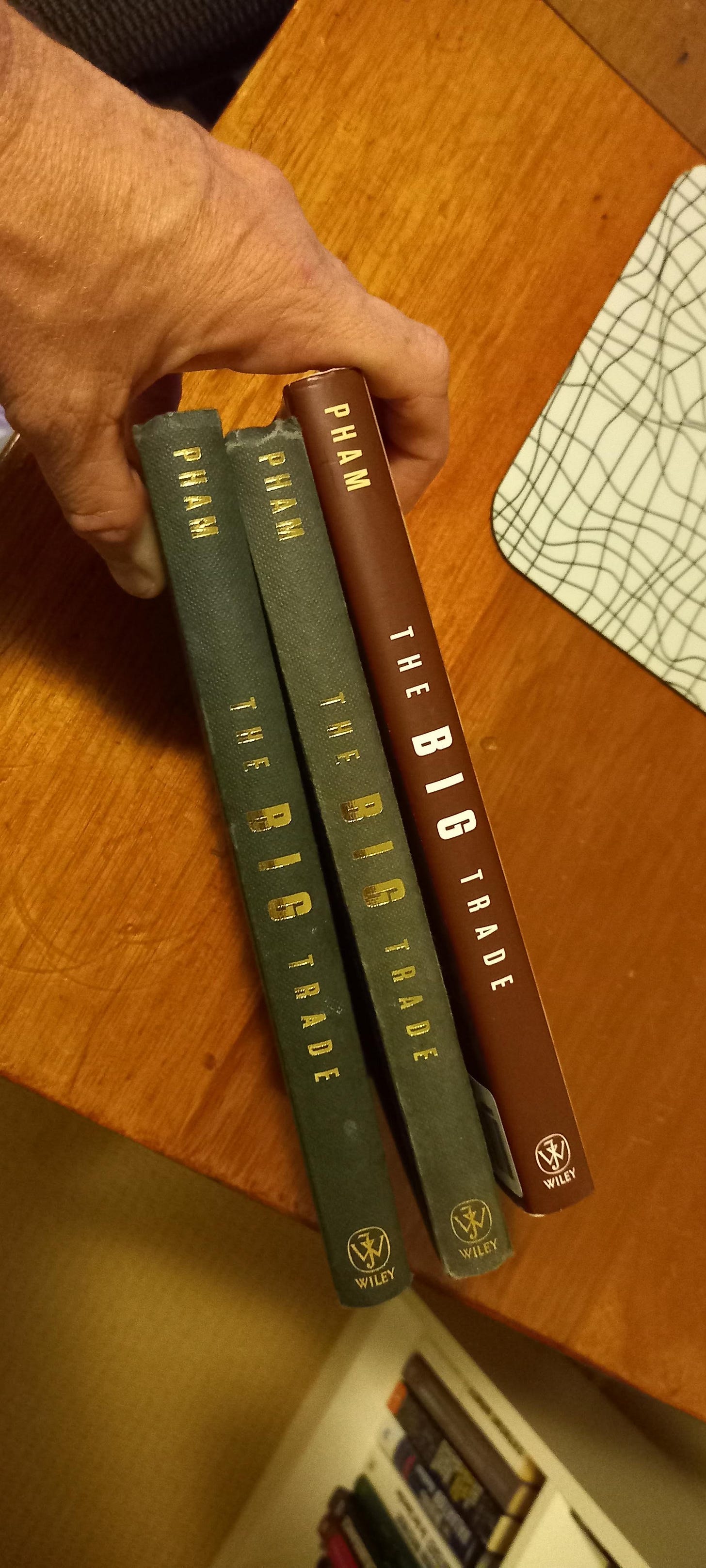

For some, the search begins in books.

Occasionally—if you’re lucky—you encounter a probabilistic framework that reframes risk, timing, or distribution. It doesn’t escape probabilistic markets, but it sharpens them. It offers a different lens—still statistical, still defensible, still safe.

Then the search moves inward, toward the network.

Access becomes the next variable. Conversations with peers. Proximity to management teams.

Event-driven strategies.

Corporate actions.

Catalysts.

The appeal is obvious: these approaches promise temporal compression—faster resolution, cleaner narratives, and relief from prolonged variance. When everyone in your network is credible, experienced, and powerful, the strategy feels not just effective, but legitimate.

Safe, even.

And then—inevitably—you speak to the author of the framework.

Not a salesman.

Not a consultant.

But someone who claims the problem can be solved at its root.

But by then, it’s already too late.

You’re no longer searching for an edge—you’re dependent on one.

Addicted to what your network offers.

To access.

To proximity.

To the quiet assurances that come from names like Goldman and their orbit.

And the further you cross the line, the more validation you receive.

Not because you’re right—but because you’re inside.

Because participation is mistaken for insight, and permission for proof.

The irony is brutal.

While you wait for regulators to deliver a sentence for misconduct, the very discovery that actually addresses drawdown, variance, and capital inefficiency begins to entrench itself—openly, legally, and empirically—in 2025 and beyond.