When Seconds Rewrite Years: The Long-Term Impact of Market Bursts

You know how the market jumps when payrolls hit or Powell speaks? That’s a burst — a fast, decisive move that resolves uncertainty. Now imagine that same kind of burst, but not from news — from me, and happening multiple times intraday.

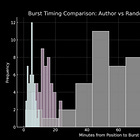

I focus on the S&P 500 futures, because they’re the master clock for global equities. When I author a burst (11:33 am E…