Why I’m in Dollars Going Into the Weekend

Iran at the Bottom of the System, the USD at the Center — and Why That Matters if Things Escalate.

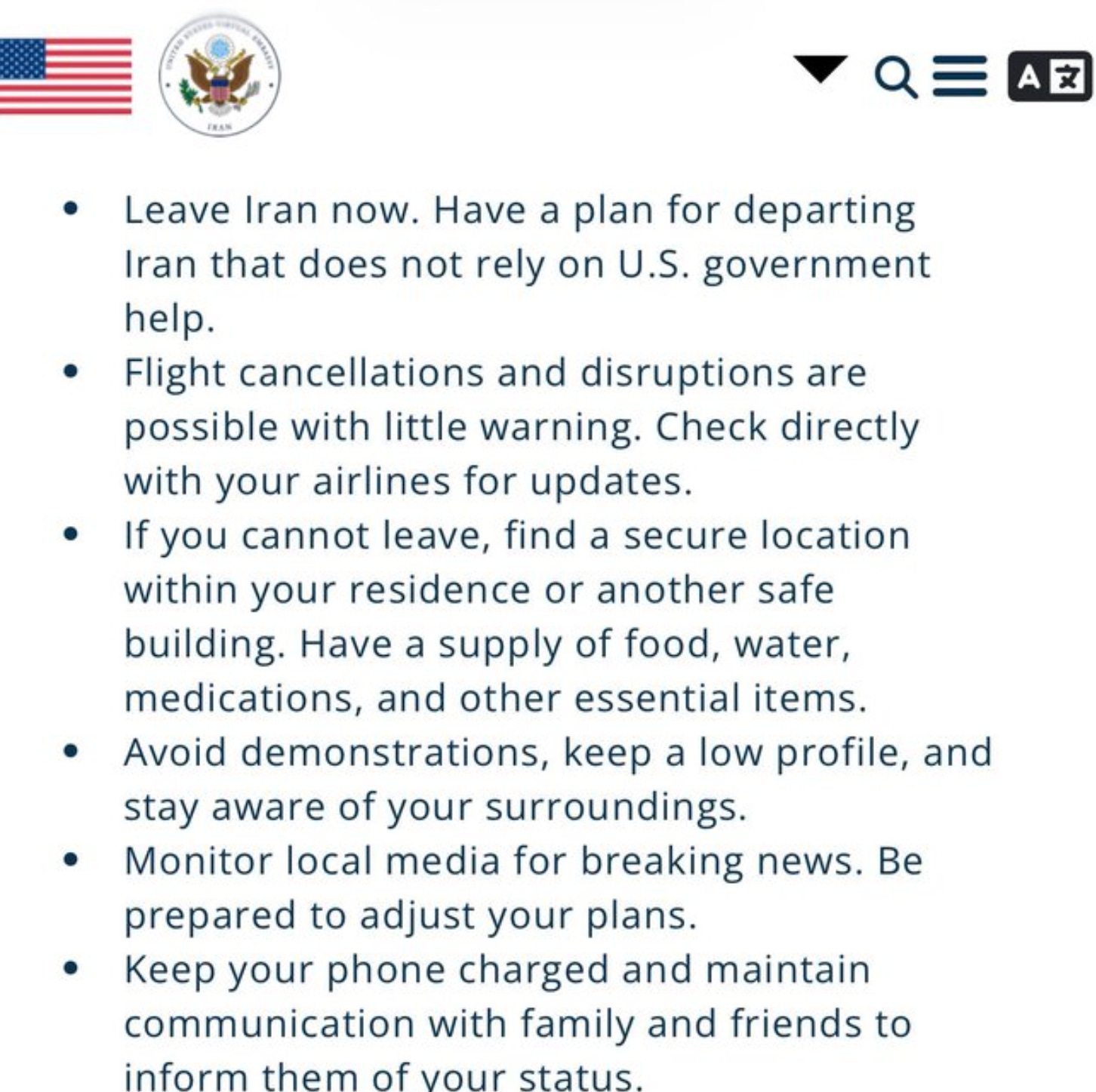

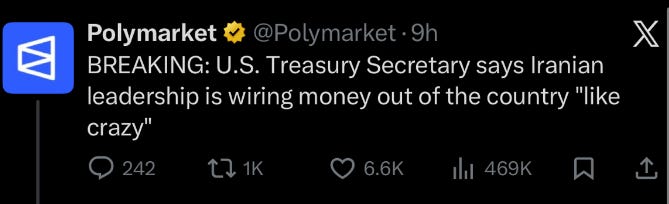

This weekend carries non-trivial geopolitical risk. Speculation that by Sunday evening the conflict involving Iran could escalate into direct military action.

Whether that happens or not is unknowable.

What is knowable is how the global financial system behaves when stress arrives.

And that behavior still runs through one place.

The U.S. dollar.

What Happens If Tensions Escalate This Weekend?

If military action occurs — or even if markets believe it might — history suggests a familiar sequence:

Risk assets wobble

Local currencies weaken

Capital seeks settlement certainty

Dollar liquidity tightens

USD demand rises — directly or synthetically

This doesn’t require a belief that the dollar is “strong forever.”

It only requires recognition that nothing else clears at scale under stress.

Gold may rise.

Crypto may trade violently.

Narratives will multiply.

But invoices, margin calls, energy flows, and emergency hedges still resolve in dollars.

This week’s The Economist Mike Bird explains how capital moves.

In contrast, I argue explain what capital cannot escape.

If Bird were fully right, then:

Gold, RMB, crypto, or equities would replace USD in moments of strain

But what actually happens?

Everything funnels back to dollars

Even “dollar-negative” hedging requires dollar markets

Even equity exits settle in USD first

That’s not preference.

That’s architecture.

That’s why my dollar bull case isn’t consensus.

And that’s exactly why it’s high caliber.

Why I’m in Dollars Going Into the Weekend

This isn’t a moral stance.

It isn’t a geopolitical prediction.

It’s a plumbing decision.

When uncertainty rises, the asset that matters most is not the one with the best story — it’s the one with the best settlement properties.

Bottom Line

The dollar’s power is not about confidence — it’s about connectivity

Sanctions don’t weaken the dollar; they demonstrate how indispensable it is

Iran is not a counterexample to USD dominance — it’s proof of it

Going into a weekend with elevated geopolitical risk, I prefer to be positioned in the currency that sits at the center of global settlement, not at the edges of speculation.

That currency is still the U.S. dollar.