During happy hour, most of your colleagues are being taught a lesson that goes against free-market principles. In their personal lives, they’ve never truly embraced the idea of being chosen in the marketplace. Instead, their relationships are more the result of orchestrated manipulation and a form of peacocking in how they met or will meet their significant other.

Perhaps this contributes to the high divorce rates—none of them have truly experienced genuine desire. This leads to a moderately reasonable coping mechanism: claiming it’s all for the kids.

This sets a poor example for those who return to their desks, and I’ll explain why.

Natural Selection

In contemplating the dynamics of the market, a thought struck me—what if we consider the market as a force akin to “Mother Nature”? This idea aligns with concepts shared by thinkers in evolutionary economics, who emphasize the primal instincts of hunting and survival in the jungle. However, there’s a crucial distinction: the perspective, or “gaze,” through which we view the market.

Traditionally, many approach the market with a “male gaze,” driven by the need to control its uncontrollable probabilistic nature. But what if, instead, we aligned ourselves with the “female gaze”—a perspective that nature itself seems to favor -chance? This shift in mindset could be the key to unlocking greater success in trading.

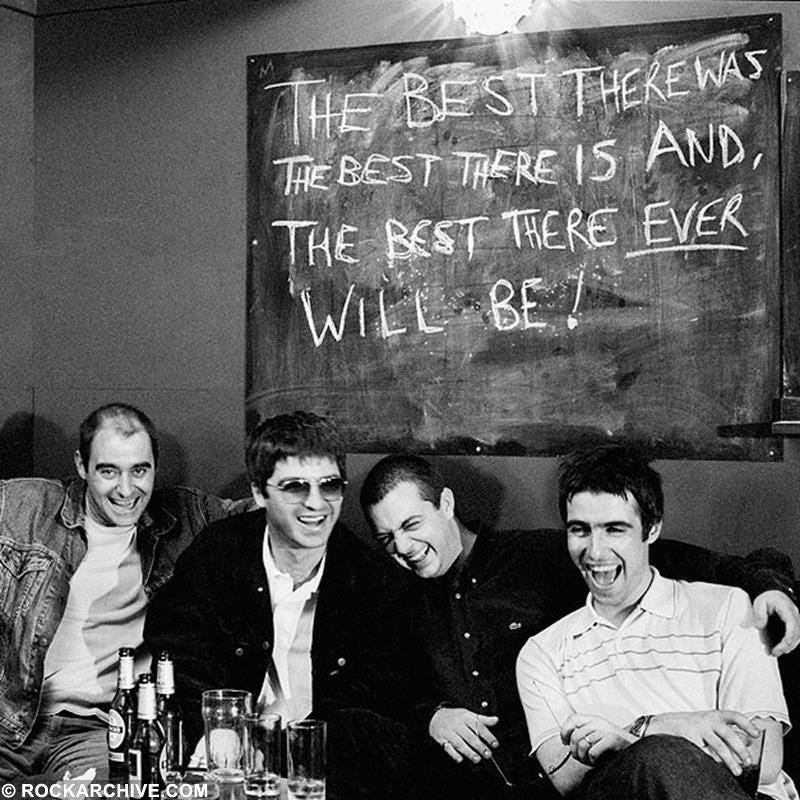

When you’ve honed a strategy with a 90% win rate, combined with a win-loss payout ratio of 2 to 1 or 3 to 1, you’re already ahead of the game. This allows you to take on calculated risks, confident that the dynamic odds are in your favor. In such a scenario, why waste energy trying to convince others—especially those entrenched in the male gaze—of your worth? For every 1,000 trades, we ascend through the grace of the market

Quant Has No Aura

Instead, let’s harness the power of nature within the market. Just as in life, where the female gaze often dictates the rhythm and response of nature -its will, we should approach the market with the same intuitive understanding. By doing so, we position ourselves as harmonizers, working in sync with the market’s natural flow, much like the adaptive market hypothesis suggests. Example below:

Interestingly, this concept of balancing “Father Time” and “Mother Nature” came to a head recently. On Friday, Fed Chairman Powell made a significant statement: “The time is now.” The key is not just to fight the market but to understand and move with it, achieving success by working in harmony with its inherent rhythms.